The world of cryptocurrency is no stranger to dramatic swings and unexpected turns. But few developments have been quite as head-turning as the former U.S. president, once a vocal skeptic of digital assets, now emerging as a major player and undeniable financial beneficiary in the space. Donald Trump, who previously expressed disdain for Bitcoin and suggested crypto was a threat to the dollar, has seemingly undergone a digital Damascene conversion – just as his family’s ventures in the sector begin yielding eye-watering returns. It’s a pivot that raises fascinating questions about evolving political stances, the allure of new wealth streams, and the unique intersection of high-stakes politics and volatile digital finance.

Recent financial disclosures have laid bare the sheer scale of the Trump family’s newfound crypto riches. Reports suggest earnings exceeding $57 million from ventures like World Liberty Financial, a cryptocurrency firm unveiled during his campaign. Add to this licensing deals, such as the $1.2 million generated from NFT collectibles and the $217,000 Melania Trump reportedly received in licensing fees related to a digital token. These figures paint a clear picture: digital assets have rapidly ascended to become one of the Trump family’s most lucrative investments. While the disclosures reportedly cover up to December 31, 2024, announcements this year about significant sales of associated digital coins only underscore the ongoing potential for massive profits, a significant portion of which the family is reportedly entitled to. This isn’t chump change; it’s a substantial financial windfall that firmly plants the former president and his family in the crypto winners’ circle.

However, this deep financial entanglement in the crypto market isn’t without its complications, particularly within the political sphere. The Trump family’s direct stake and significant earnings are reportedly creating a hitch in GOP efforts to build bipartisan consensus on digital asset legislation. Democrats and even some Republicans are voicing concerns about potential conflicts of interest, questioning how a political figure with such direct financial exposure can objectively shape policy that would inevitably impact their personal wealth. The optics are challenging, fueling accusations that policy positions might be influenced by personal gain rather than sound economic or technological principles. This situation highlights a growing challenge in the digital age: how to navigate the blurred lines between personal investments by political leaders and the regulatory frameworks they are tasked with overseeing.

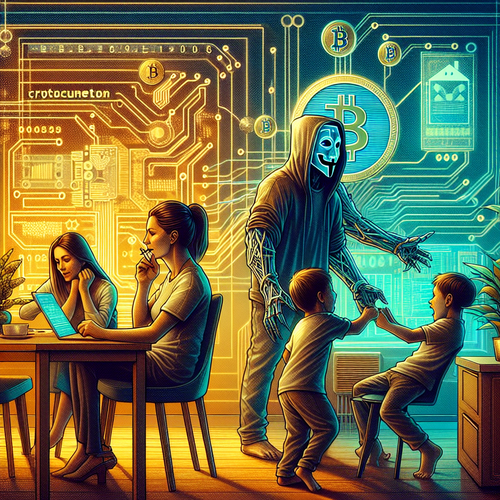

Delving deeper into the nature of these ventures reveals a landscape familiar to the wild west days of crypto. Beyond traditional firm investments, Mr. Trump has reportedly developed a personal cryptocurrency, known as $TRUMP, a memecoin launched just before his inauguration. Memecoins, often characterized by their speculative nature and value driven by social media hype rather than underlying utility, stand in stark contrast to more established digital assets. The reported potential valuation of this memecoin on paper is cited as potentially worth billions, though such valuations are notoriously volatile and dependent on market sentiment. The involvement in licensing deals for NFTs – another speculative corner of the market – further illustrates an approach that seems less focused on foundational blockchain technology and more on brand monetization through digital assets. Critics have even raised concerns, as one report suggests, about the potential for these ventures to resemble “pump and dump” schemes, particularly if there are suggestions of leveraging political influence for personal profit, such as the controversial idea of exchanging US gold reserves for crypto.

The narrative arc from crypto skeptic to crypto czar is not just a personal financial story; it’s a potent symbol of cryptocurrency’s mainstreaming, albeit through a controversial political lens. The significant wealth generated underscores the transformative, if volatile, power of digital assets. Yet, the entanglement of a leading political figure with speculative assets and the potential for conflicts of interest raise critical questions about transparency, ethics, and the future of digital asset regulation in the United States. As crypto continues its march into mainstream finance and political discourse, the Trump family’s deep dive serves as a powerful, and perhaps cautionary, tale about the challenges of integrating new, unregulated, and highly profitable technologies with the principles of public service and ethical governance. The coming months may well test the boundaries of this unprecedented intersection.